Tuning In to Help:

Supporting Musicians Through Financial Crisis

Musicians Lifeline stands as a beacon of support for greater New England musicians and music professionals. We extend a helping hand to members of the local music industry who are facing unexpected hardship due to illness, disability, age, unemployment and other financial crises. We show up to support YOU!

Gigs don’t come with health insurance.

Behind the scenes, the reality for musicians isn't always as glamorous as it seems. There's no safety net of health insurance or retirement plans, no guaranteed hours of work, and no salary check. Each gig is simply a paycheck. Many musicians live paycheck to paycheck, with uncertainty looming.

Through benefit ticket sales, donations, and sponsorships, we generate funds to alleviate financial burdens such as medical expenses, prescriptions, insurance premiums, housing, utilities, and counseling fees.

About Musicians Lifeline

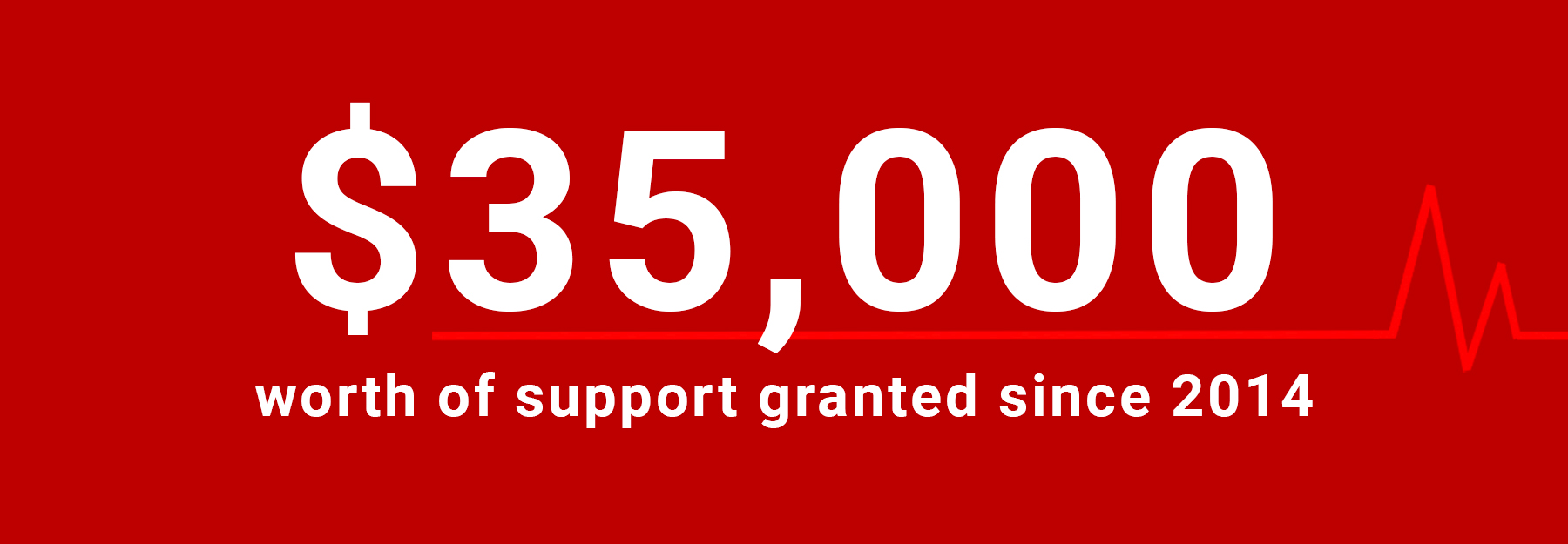

Musicians Lifeline,Inc. a 501-C(3), was founded in 2014 with the mission to help New England’s professional musicians with medical and social needs to allow the musician to continue to play gigs and earn a living. Grants are voted on by the Board of Directors, and money is given to a creditor or service provider which may be a Doctor, Hospital, Landlord, car repair garage, or other such service provider.

Musicians Lifeline,Inc. a 501-C(3), was founded in 2014 with the mission to help New England’s professional musicians with medical and social needs to allow the musician to continue to play gigs and earn a living. Grants are voted on by the Board of Directors, and money is given to a creditor or service provider which may be a Doctor, Hospital, Landlord, car repair garage, or other such service provider.

The fund has helped struggling musicians with end-of-life assistance, ALS medication, LUPUS, blindness care, car liens, eviction due to illness, medical procedures, utility payments and a variety of other grants.

Benefit Fundraiser held May 7, 2023

Thank you to everyone who attended and supported our first fundraiser since the pandemic.